Overview

Weeks 17 – 20 (w/b 22 April – w/b 13 May)

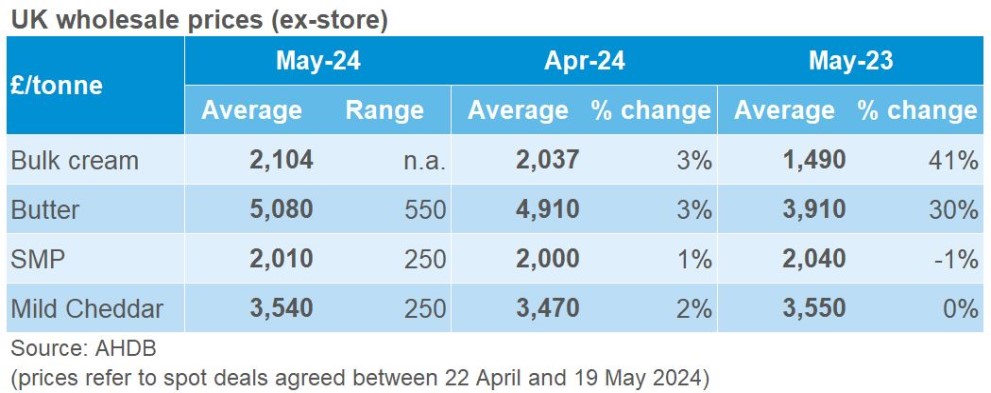

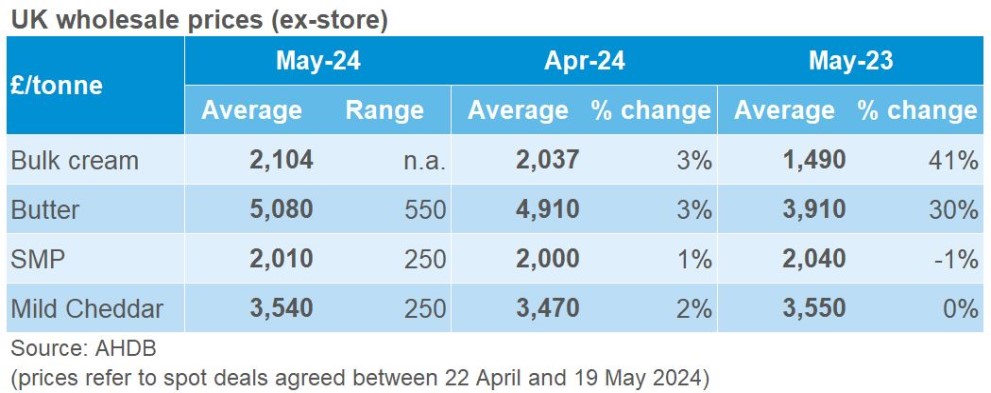

Despite all product categories recording an uplift in pricing in May, it was a month of two parts. All contributors noted that growth in prices only came in the last week to 10 days, as enquires increased following a disappointing peak in milk production. Prior to this, markets had been flat with little change from the previous month. Important to note that average prices are reflective of the whole of the 4-week period.

Bulk cream prices were said to be ‘steady eddy’ at the start of the month in the mid-£2,000, however at the end of the period it was reported that some loads were going for around £2,200 as demand picked up. There was some volatility reported due to excess spot milk as a result of processing breakdowns. Overall the market tone was positive.

Butter prices recorded the strongest growth, up £170 month on month. As with cream the market was reported as steady at the start of the period with little movement from April but at the end of the month prices jumped up significantly with some quotes close to £5,400. It seems that buyers aren’t as well covered as first thought as many returned to the market in the most recent week. There are concerns over stocks due to lower than anticipated milk volumes.

SMP markets saw the smallest change month on month, up just £10. The market was still reported as relatively quiet, but a positive undertone was present. The GDT index rose during the period, providing some support, however it was noted that the price difference to US product was noticeable in global trade.

Mild cheddar followed the trend set by butter and cream markets. Mild was noted to have seen less price movement than other cheese such as mature, but still showed good growth with prices up £70 in May compared to April. Market tone is positive with buyers coming back online alongside some concerns around future stocks.

Full link to report -

UK wholesale prices | AHDB